In regards to the Nexo debit card (which is still in the early access phase), customers can fund the card using crypto and spend its afferent value by either withdrawing from ATMs, making online purchases, or buying things in-store via POS devices. Prosįounded in 2018, Nexo represents an innovative crypto-based banking platform that offers a variety of fintech services to over 800,000 users in 200+ jurisdictions.Īt this point in time, Nexo offers 3 key services: a cryptocurrency debit card powered by MasterCard, a lending platform for cash and stablecoins, and an earning service that allows users to obtain daily compounding interest on their crypto and fiat deposits. A 0.5% interbank exchange is charged after exhausting the monthly exchange limit.

Bitpay debit card limits free#

Debit card holders will pay a 2% ATM withdrawal fee after surpassing the free limit. Feesįees and limits are dependent on your debit card tier. Some of these nations include Congo, Haiti, Iraq, Iran, Gambia, Liberia, Macedonia, Sudan, and Montenegro. The MCO debit card is unusable in several countries, due to regulatory struggles. High tier card owners will unlock bonus interest, a private concierge, a merchandise welcome pack, access to airport lounges, and higher no-fee limits. Expedia and Airbnb discounts are available as well. With this in mind, users can unlock cashbacks together with free Spotify, Netflix, and Amazon Prime subscriptions.

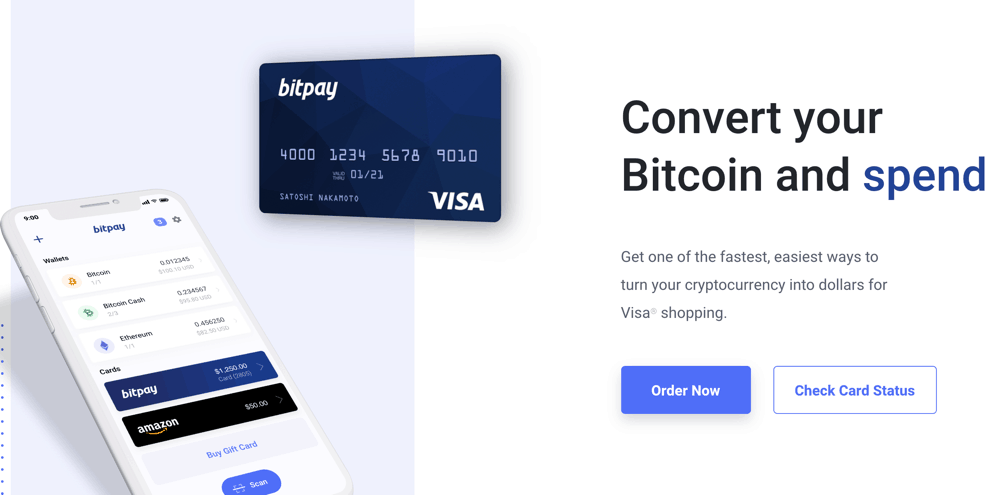

Higher CRO staking will gain you access to improved card tiers. CRO is obtained either by purchase or as a reward for spending via the card. When signing up for a card, users can choose to stake CRO in order to obtain perks and rewards. Improved interest rates are granted to those who stake CRO, a native token enabling cross-asset currency settlement within the blockchain. The credit can be spent directly via the company’s Visa card. In regards to the lending service, users can deposit crypto as collateral and obtain an instant loan in USD, PAX, USDC or TUSD. Payments and ATM withdrawals are supported wherever Visa is accepted. The crypto debit card can be funded via crypto deposits, which are instantly converted to the user’s currency of choice. These include a fully-fledged exchange platform, a DeFi and crypto wallet, the ability to stake coins in exchange for interest, a crypto payment processing platform, and a lending service.

Bitpay debit card limits series#

So far, the platform has attracted over 2 million users.Ĭ provides a digital currency-funded MCO debit card, alongside a series of other services. Founded in 2016, the company believes that people throughout the world should have the liberty of freely controlling their online money, identity, and data. Top Cryptocurrency Debit CardsĬ represents one of the world’s most popular crypto debit card providers. A pros and cons table will further highlight the main advantages and disadvantages of these providers. Readers will learn more about their main features, perks, rewards, fees, and geographic restrictions. This article will focus on reviewing the market’s best cryptocurrency debit cards. Over the last couple of years, multiple companies have launched such services, in collaboration with Visa and MasterCard.

ATM withdrawals, in-store payments and online transactions can all be carried out via these cards, directly from one’s cryptocurrency holdings.

Providers of such cards allow users to deposit bitcoin and other coins into an online account that converts the coin to fiat whenever users wish to spend money. Withdrawals to bank accounts and debit cards take time – thus, crypto-based money is not easily accessible when required for day-to-day spending.Ī current solution to this problem is the use of cryptocurrency-based debit cards. Indeed, cryptocurrency exchanges are great when it comes down to converting cryptocurrencies to fiat, but they have their limitations. However, this is only bound to happen as mass adoption grows, therefore creating a paradox: mass-adoption cannot be attained if merchants refuse to process crypto-based payments, whereas this refusal will continue if users do not demand this service. Of course, this problem could be easily dealt with if merchants worldwide were more open to the world of cryptocurrencies. One of the underlying problems of digital currencies is that they lack instant liquidity, thereby affecting their potential as a means of payment. A review of the best cryptocurrency debit cards available today

0 kommentar(er)

0 kommentar(er)